Wenn Leute fragen, wann ein „Cart“ (Vape-Cartridge mit Cannabis/THC-Extrakt) „hit“ – also spürbar wirkt – geht es meist um zwei

Search interest and shelf space have shifted hard toward “smart” disposables—bigger formats, louder flavors, and more UX features (screens, modes, switching). If you’re tracking the trend from a U.S. retail or B2B sourcing angle, the phrase USA whole melt v7 disposable vape pen has become a shorthand for that next-gen disposable category: dual options, screen-driven feedback, and “grab-and-go” convenience.

Important note: public, independently verified brand-level sales data for “Whole Melt V7” specifically is limited. So the most reliable way to understand “why it’s taking over” is to anchor on authoritative U.S. category data (sales mix + youth device-type mix + enforcement signals), then map where V7-style feature sets fit.

Over the last few years, disposables moved from “one option” to the dominant format in tracked U.S. e-cigarette sales. In syndicated U.S. retail tracking, disposable e-cigarette unit share climbed from about 26.0% (Feb 2020) to 60.9% (May 18, 2025), with disposable unit sales rising from roughly 4.1M units to 12.3M units over the same period.

Disposables are heavily flavor-led: as of May 18, 2025, about 94.7% of tracked disposable sales were non-tobacco flavors—one reason the segment keeps winning “impulse” retail battles.

The 2024 National Youth Tobacco Survey (NYTS) reported 1.63 million middle and high school students currently used e-cigarettes (5.9%). Among current youth e-cigarette users, 55.6% used disposables, and 87.6% used flavored products—signals that directly influence enforcement and state-level rules.

“Whole Melt V7” is commonly positioned online as a dual-option disposable with a screen—features that mirror broader category momentum (especially “smart vape” UX). Across listings, the device is often described with a dual-chamber format (commonly shown as 1 ml + 1 ml), USB-C recharge, and ceramic heating. Specs vary by seller and should be verified in your supply chain.

The strongest behavioral driver behind dual systems is simple: customers feel like they’re getting “two products in one.” In practice, dual designs aim to reduce flavor fatigue, improve “shareability,” and justify a higher price point or faster turnover.

Screen-equipped disposables (“smart vapes”) aren’t a niche anymore—major tracked brands include screen-enabled models. That matters because screens communicate battery, mode, and usage cues at a glance, reducing returns tied to “it’s dead” or “it’s not hitting” confusion.

Large-format disposables (often marketed with high puff counts) make rechargeable USB-C less of a “premium add-on” and more of a requirement to finish the device. Ceramic heaters are also widely marketed for consistency and reduced burnt notes.

| Feature | Often advertised (varies by listing) | Why it matters commercially |

|---|---|---|

| Capacity / format | Dual chamber (often shown as 1 ml + 1 ml) | “Two-in-one” value perception; faster shelf decision |

| Battery | ~450 mAh rechargeable | Reduces “unfinished device” complaints in big-format disposables |

| Charging | USB-C | Convenience + lower friction for repeat purchase |

| Heater | Ceramic heater; resistance commonly listed around ~1.3–1.4Ω | Consistency narrative; fewer burnt/harsh return reasons |

| Interface | Digital screen / LED display | “Smart vape” category signal; improves perceived quality |

A major reason disposable formats “dominate” shelf presence is that a large share of products in mainstream U.S. retail channels are unauthorized. In 2024, unauthorized flavored disposable vape sales were estimated around $2.4B, roughly 35% of the tracked U.S. e-cigarette market in major outlets (with important caveats: tracking excludes online and many specialty shops).

Federal enforcement signals have intensified. In one 2025 joint operation, FDA and CBP reported seizing nearly 2 million unauthorized e-cigarette units (estimated retail value $33.8M). Later in 2025, HHS/FDA/CBP announced a larger Chicago operation seizing 4.7 million units valued at $86.5M—and stated that only a limited set of e-cigarette products are authorized for legal marketing in the U.S.

The category is still moving toward more “device-like” UX (screens, indicators, modes), while regulators push harder on unauthorized products and youth access. In other words: feature-led demand will likely remain strong, but the winners will be the suppliers and brands that can keep product availability stable under rising scrutiny.

If you’re evaluating “Whole Melt V7” demand as a market signal, treat it less like a single SKU story and more like a signpost for what buyers currently reward: convenience, strong flavor expectations, multi-option choice, and visible UX feedback—all wrapped in a format that’s easy to stock and easy to sell.

Attention : USA Whole Melt V7 Vape 2g | whole melt vape | dual chamber disposable bulk | USA Stock vape | custom vape

Wenn Leute fragen, wann ein „Cart“ (Vape-Cartridge mit Cannabis/THC-Extrakt) „hit“ – also spürbar wirkt – geht es meist um zwei

plume vape pen wholesale (2026): Welche „Wholesale-Vorteile“ realistisch sind – und wo Compliance über Profit entscheidet Wer nach plume vape

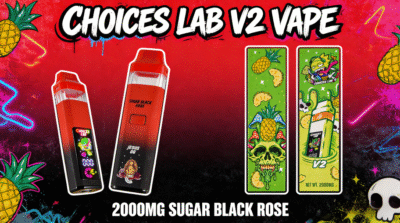

Top 5 “Affordable ChoiceLab V2 Disposable Carts” für Budget-Vaper: 5 Profi-Checks, bevor du am falschen Ende sparst Keyword (SEO): cheap

Hello, please contact us if you have any questions! ↑↑↑You can use upper link to find me! Please fell free to contact us! Thank you!